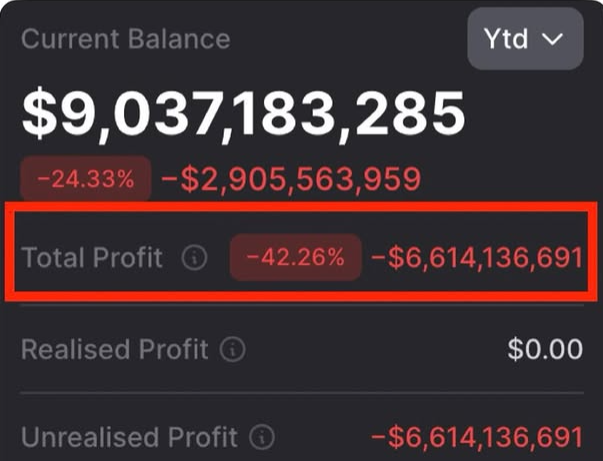

A recent market update circulating online highlights significant unrealized losses tied to BitMine ($BMNR) and its Ethereum (ETH) exposure. According to the data shown, unrealized losses have climbed to approximately $6.6 billion, positioning the company on track to record what could become the fifth-largest documented principal trading loss in history — if those positions were liquidated.

The report compares the scale of the losses to the infamous 2021 Archegos collapse, noting that current unrealized losses are roughly 66% of that event’s size. While no realized loss has yet been recorded, the size of the paper drawdown underscores the risks associated with concentrated crypto positions, particularly in volatile markets.

The distinction between realized and unrealized losses is critical. Unrealized losses reflect market value declines on open positions and can fluctuate significantly depending on price recovery. However, sustained drawdowns of this magnitude can raise liquidity concerns, investor anxiety, and broader market pressure — especially if forced selling becomes necessary.

This situation highlights the extreme volatility inherent in digital asset markets and serves as a reminder that leverage, concentration risk, and rapid price swings can dramatically reshape balance sheets in a short period of time.